First Choice Credit Cards

First Choice Credit Cards

The First Choice credit cards are MasterCard products: Gold, Classic, and Classic Secured. All these three products allow a grace period on purchases that is also interest-free (25 days), the opportunity to perform balance transfers, and retrieve a cash advance worldwide in ATMs.

MasterCard Classic Secured: 15.9% APR fixed rate.

This product is only suitable for those who do not have a credit history and for those users who want to gradually improve and rebuild their credit. This card is only to be used in these cases. If you enjoy a better credit score, you should avoid this product and move towards other cards we are indicating below.

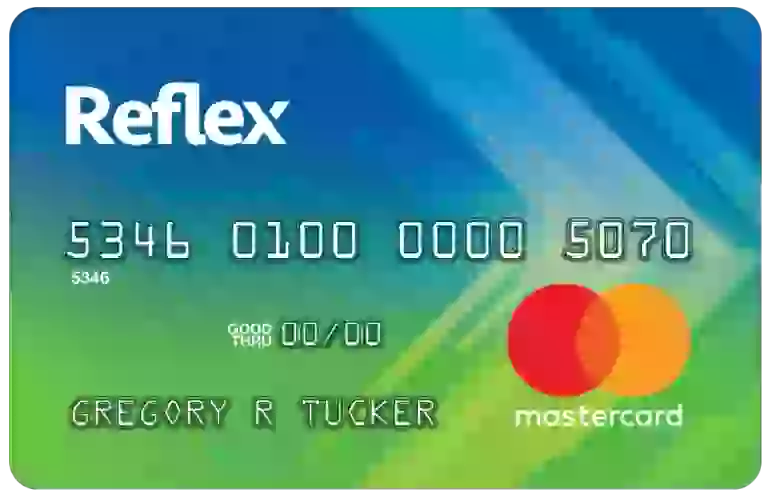

This product is much more convenient than one we previously reviewed, that was the Reflex card offered by Celtic Bank. Read that article here. The reason is that whereas with First Choice, the interest is 15.9%, with Celtic Bank, for the Reflex secured card is 29.9%. Also, there are hefty annual fees with the Reflex MasterCard at Celtic Bank.

Also convenient as this First Choice secured card option is another product we reviewed that is the Midfirst Visa Secured. Midfirst option has an annual fee of $19 dollars whereas this card does not have an annual fee. Furthermore, we consider that currently, the Zero Liability policy from Visa is more protective in case of unauthorized charges or fraud than what MasterCard offers. So there, in terms of safety, there is an advantage for the Visa Secured offered by Midfirst that we study here in this article.

We have to say now that there are no annual fees with this secured card.

The users must sign an account with First Choice and complete a deposit to secure the limit on the card. This account may also be utilized to secure a card for another authorized person.

There are no rewards programs or cashback options with this secured credit card.

MasterCard Classic 14.76% APR fixed rate.

For people with better credit that do not need a secured card, this product is the next step after building your credit or reestablishing from bad credit. Also good is that there are no annual fees. You are not required to secure a deposit. However, you do not enjoy the lower APR from the Mastercard Gold. If you have a high credit score, then this card is not for you because you would be paying 14.76% APR that is six percent more than with the MasterCard Gold.

Some users in our forums were requesting this card and noticed that there is no associated rewards program. There are plans to have also a rewards program in the future.

MasterCard Gold 8.75% Fixed Rate APR

For users with a good score, this is the best of the First Choice credit cards available. Low rates, no annual fees, and a rewards program are included in this product. If you do not reach yet a good credit, then you should be moving one step down, to the Master Card Gold, and pay six percent APR more.

Conclusions For The First Choice Credit Cards

If you looking for secured credit cards, then I would like to recommend the MasterCard Classic Secured, one of the three First Choice credit cars available. The reason is that this secured card has a quite reasonable APR of about 15%, no maintenance fees, no annual fees, and a grace period on purchases that is of 25 days and interest-free.

If you are instead looking for unsecured cards, then the MasterCards Classic and Gold are similar to other standard offers in the market. Therefore it is an option if you are also a customer of First Choice or you could be opening an account there.

Related Articles

Related to this topic, there are some interesting reviews of credit cards and products related to debit cards and prepaid cards that I would like to suggest you read. I have kept the list short with some featured articles: Mid America credit cards, DCU credit cards, Midfirst cards, First Choice credit cards, the Walmart Rewards Card, the Ace Elite Visa Prepaid, the Venmo Debit Card, and the Relax Mastercard.

Furthermore, the discussion about the possibility of having two or more credit cards from the same bank.

I am David, economist, originally from Britain, and studied in Germany and Canada. I am now living in the United States. I have a house in Ontario, but I actually never go. I wrote some books about sovereign debt, and mortgage loans. I am currently retired and dedicate most of my time to fishing. There were many topics in personal finances that have currently changed and other that I have never published before. So now in Business Finance, I found the opportunity to do so. Please let me know in the comments section which are your thoughts. Thank you and have a happy reading.